In Warwickshire, the antique and estate markets are significant platforms for auctioning historical artifacts and heirlooms, with expert auctioneers at their core, providing in-depth knowledge on item backgrounds and valuations, particularly in probate situations. Probate Loans Warwickshire offer a vital financial service for those managing estate settlements by providing immediate liquidity, complementing the auction scene and facilitating the acquisition of treasured pieces. This synergy showcases a dynamic market where tradition meets modern solutions, ensuring smooth asset transitions and fostering economic activity within the county. Probate Loans Warwickshire are crucial for executors under financial strain, as they align with the probate timeline to settle debts, maintain living expenses, and expedite estate sales without delaying beneficiaries' access to their inheritance. These loans are tailored to assist with the complexities of estate administration and the legal requirements of probate in Warwickshire, ensuring executors can navigate the process effectively and adhere to the deceased's wishes.

Navigating the rich tapestry of Warwickshire’s antique and estate markets can be a fascinating yet complex endeavor. For those seeking to liquidate estates or part with cherished heirlooms, the expertise of professional auctioneers plays a pivotal role. This article delves into the nuanced world of Warwickshire’s auction scene, highlighting the significance of engaging expert auctioneers who understand the local market’s intricacies. It also provides valuable insights into how probate loans can aid in estate liquidation, especially when dealing with assets that require quick sale facilitation. Whether you’re an executor handling a probate situation or a collector looking to invest, this guide is tailored to assist you in selecting the right professional auctioneer for your Warwickshire estate sale. Understanding the legalities and financial implications of auctions, particularly with probate loans, ensures a smooth transaction.

- Exploring the Role of Expert Auctioneers in Warwickshire's Antique and Estate Markets

- Navigating Probate: How Probate Loans Can Facilitate Estate Liquidation in Warwickshire

- The Essential Guide to Selecting a Professional Auctioneer for Your Warwickshire Estate Sale

- Insights into the Legalities and Financial Considerations of Selling through Auctions in Warwickshire with Probate Loans

Exploring the Role of Expert Auctioneers in Warwickshire's Antique and Estate Markets

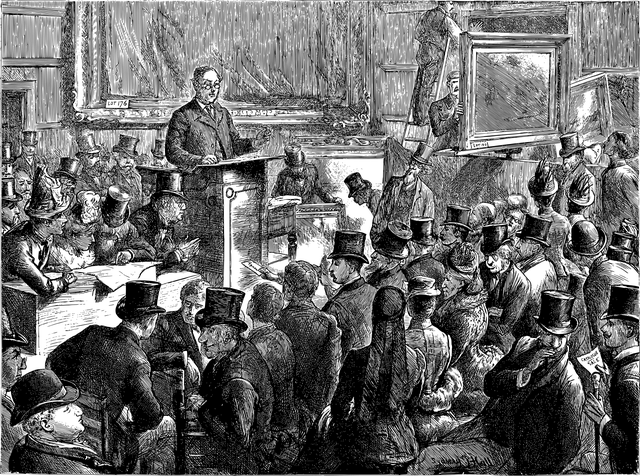

In Warwickshire, the antique and estate markets are thriving hubs of historical artifacts and treasured heirlooms, where the expertise of professional auctioneers plays a pivotal role. These seasoned experts not only curate and present these pieces to discerning buyers but also provide invaluable insights into their provenance and value. The auctioneers’ knowledge is particularly crucial when it comes to probate assets, where understanding the market and the items’ history is essential for accurate valuation and fair auctioning. Probate Loans Warwickshire is a testament to the financial services that intersect with this niche market, offering liquidity solutions for those settling estates. This service recognizes the importance of auctioneers who appraise and sell items as part of the probate process, ensuring that heirs receive their due inheritance while also facilitating the acquisition of sought-after pieces by collectors and investors alike. The seamless integration of these financial services with the expertise of local auctioneers underscores the interconnected nature of Warwickshire’s antique and estate markets, making it a region where both tradition and modern financial solutions converge.

Navigating Probate: How Probate Loans Can Facilitate Estate Liquidation in Warwickshire

When an individual passes away, their estate often enters a complex legal process known as probate. This period can be challenging for grieving families who must also manage the deceased’s affairs. In Warwickshire, navigating the intricacies of probate is essential to ensure the fair distribution of assets according to the will or intestacy laws. For those facing financial pressures during this time, probate loans in Warwickshire can be a pivotal solution. These loans are specifically designed to provide the necessary funds to executors, enabling them to settle debts, cover living expenses, and most importantly, facilitate the liquidation of estates. This timely access to capital can significantly ease the burden of estate management, allowing for the orderly disposal of assets as stipulated by the law.

The process of probate often involves the sale of real estate or personal property, which can take considerable time to complete. Probate loans Warwickshire offer an alternative to heirs who may need immediate access to their inheritance without waiting for the entire estate to be settled. These financial instruments are structured with an understanding of the probate timeline, offering a bridge over the financial gaps that can occur during this period. With the aid of these loans, beneficiaries and executors can expedite the estate liquidation process, ensuring that the deceased’s assets are handled in a manner that respects their wishes and settles any outstanding obligations in a timely fashion.

The Essential Guide to Selecting a Professional Auctioneer for Your Warwickshire Estate Sale

When planning an estate sale in Warwickshire, the process of selecting a professional auctioneer is pivotal to ensure the best possible outcomes. A reputable auctioneer brings expertise, a deep understanding of local markets, and access to networks of potential buyers. They can effectively market your items, accurately appraise them, and facilitate a smooth transaction. In Warwickshire, where estates often hold unique and valuable items, an experienced auctioneer’s knowledge is invaluable, particularly when dealing with high-value assets that may require specialized handling.

For those who might be considering probate loans in Warwickshire, it’s crucial to engage with an auctioneer who not only understands the legal aspects associated with estate settlement but also has a proven track record of managing such sales efficiently. This ensures that the estate’s assets are liquidated effectively, potentially providing the necessary funds for settling any outstanding debts or legacies. When exploring probate loans, it’s advisable to select an auctioneer who is well-versed in navigating these financial instruments, ensuring that the sale complements and supports your financial goals during this sensitive time. Their expertise can be a guiding light through the complexities of estate liquidation and financial planning post-probate.

Insights into the Legalities and Financial Considerations of Selling through Auctions in Warwickshire with Probate Loans

Navigating the legal landscape of selling assets through auctions, particularly when dealing with estates subject to probate in Warwickshire, requires a thorough understanding of the local regulations and financial implications. Probate Loans emerge as a pivotal solution for executors facing the challenge of liquidity during this process. The legal framework governing probate is intricate and varies by jurisdiction, necessitating expert guidance to ensure compliance with the Rules of the Supreme Court and the Probate Registry’s requirements. Executors must adhere strictly to these guidelines to avoid potential complications or delays in the administration of the estate.

Financial considerations are equally paramount when auctioning assets under probate. Liquidating property through auctions can be a strategic approach, but it must be executed with careful planning. Probate Loans Warwickshire offer a financial lifeline for executors who need to settle debts, pay inheritance tax, or simply manage the estate’s immediate expenses without waiting for the sale proceeds. These loans are designed to facilitate the auction process, allowing for a timely and orderly disposition of assets. When considering an auction, it is crucial to weigh the costs associated with auctioning against the potential returns to ensure the best possible outcome for all beneficiaries involved.

In Warwickshire, the auctioneer’s gavel not only signals the start of bidding but also plays a pivotal role in the seamless transition of antiques and estates. Our exploration reveals the expertise of local auctioneers as they navigate the complexities of Warwickshire’s antique and estate markets with finesse. When faced with the intricacies of probate, leveraging Probate Loans Warwickshire can alleviate financial burdens, ensuring a smoother liquidation process. For those looking to conduct an estate sale, the guide to selecting a professional auctioneer provides vital advice to make informed decisions. The article also sheds light on the legal and financial nuances involved in auctions, particularly when probate loans are utilized. Ultimately, the convergence of local expertise with the practicalities of probate finance stands as a testament to the thriving market within Warwickshire’s heritage-rich landscape.